39+ can i claim mortgage interest on taxes

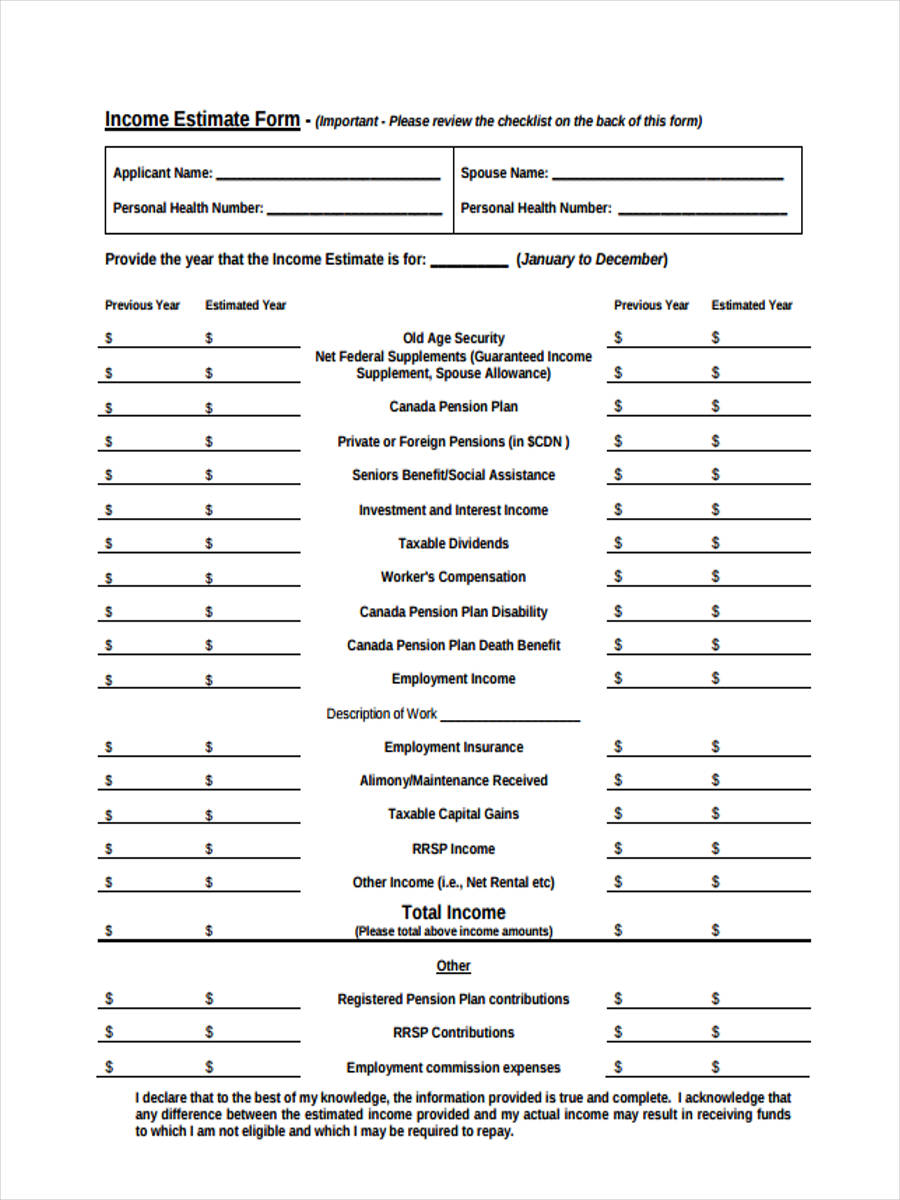

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions.

Mortgage Interest Deduction Bankrate

Your mortgage lender sends you.

. If you are on the deed with someone else you should divide the amounts you paid and report them. The write-off is limited to interest on up to 750000 375000 for married-filing. Look in your mailbox for Form 1098.

Web The short answer is. File your taxes stress-free online with TaxAct. Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web The interest you pay for your mortgage can be deducted from your taxes. Ad Over 90 million taxes filed with TaxAct.

For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Web Then yes you can enter the interest paid on the mortgage. If the Mortgage Interest is for your main home you would enter the.

Answer Simple Questions About Your Life And We Do The Rest. Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. Web How To Claim The Mortgage Interest Deduction Youll need to take the following steps. Web Mortgage interest deduction limit.

You dont have to be an. If your home was purchased before Dec. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

750000 if the loan was finalized. Homeowners who bought houses before. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

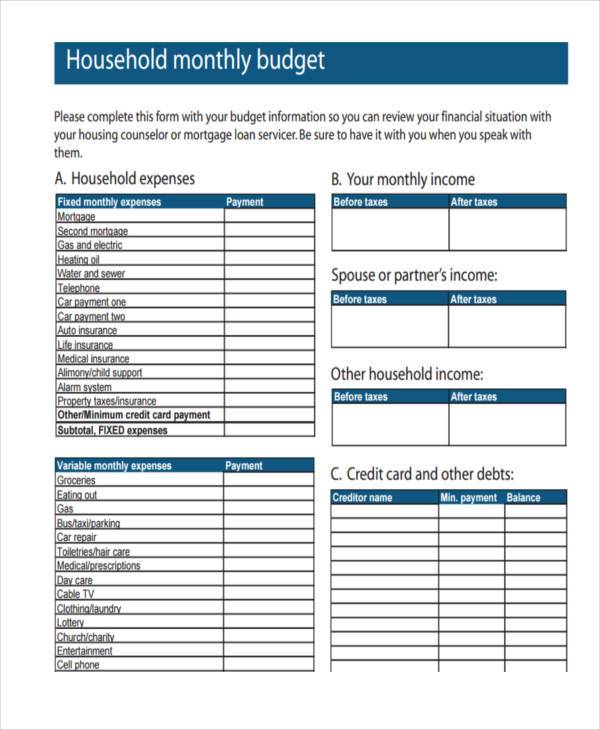

Start basic federal filing for free. Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Web To deduct mortgage interest you must be legally obligated to pay the mortgage a borrower and you must actually pay the interest. Filing your taxes just became easier. It all depends on how the property is used.

16 2017 you can deduct the mortgage interest paid on your first 1 million in.

Mortgage Interest Deduction Rules Limits For 2023

Changes To Tax Relief For Residential Property Landlords Business Clan

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Mortgage Interest Deduction Bankrate

Section 24 Hmrc Uk Tax Changes National Residential

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore

Mortgage Interest Deduction Rules Limits For 2023

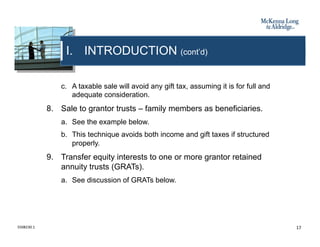

Business Succession Planning And Exit Strategies For The Closely Held

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

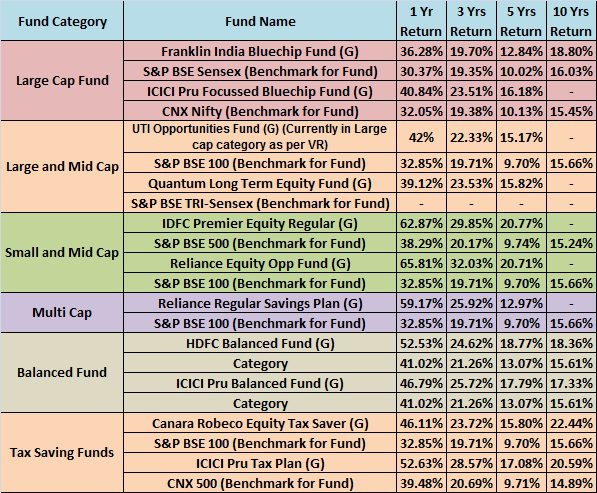

Top 10 Best Mutual Funds To Invest In India For 2015

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction A Guide Rocket Mortgage